Out and About

The last two weeks have been really like a royal roller coaster of juggling familly , travelling to a new venture, making desicionsand then still trying to keep my self-together,

Well you know that time when it really gets cold and the weather turns cold and really wet either drizzle or mist like you walk in dry and buy the time you get to the outher side it looks like you ran thruogh a washing machine, yeah that sort of weather is not really good for me, it send me to bed for like a month. Took me 3 Hours of my time to get to my destination

Well during the weak I got a call from Insurance Assits about a Service I Offer ( thats a whole different story though , i will get into that a little later), went to the company, Looked at soft ware they had been developing for Insurance Agencies Small to meduim Sized, when I first looked at the software I must say I was very Impressed with the soft ware as it was really user friendy.. easy to follow the steps, the software speaks for its self, I had a meeting with the companies Cfo and Ceo and after some mutual discussion and arrangement of the terms of service,

I was given the goal of getting thier sales department producing more than a sale a week, I was then introduced to thier one and only sales person, studied him for a week , got to know thier software and looked at thier marketing, I also phoned some clients and set up some demos, We will hear how those went during the course of this week,

Two Weeks,

Two Weeks,

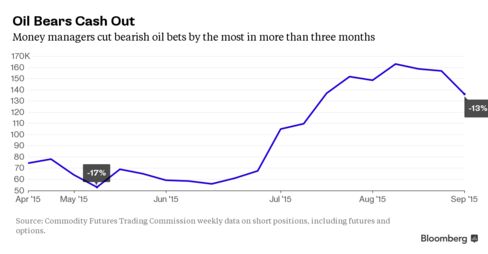

Oil bears are cashing out.

Hedge funds slashed short positions in West Texas Intermediate by 13 percent in the week ended Sept. 1 as the largest three-day rally in 25 years sent crude up by almost $10 a barrel before it dropped again. It was the biggest liquidation of bearish bets since May.

The week made for a wild ride in the crude markets as volatility jumped to a five-month high amid anxiety about a stubborn worldwide glut of crude. Rising production from Iran and the U.S. combined with weaker demand from China put an end to three days of gains on Sept. 1, the last day of the report week, as oil plummeted 7.7 percent.

“There’s a lot of nervousness in this market,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. “Everyone is retrenching in the face of this extreme volatility.”

Money managers cut short positions, or bets that prices will fall, by 21,009 futures and options combined, U.S. Commodity Futures Trading Commission data showed. Net-long positions increased by 16,826 contracts as bullish wagers also declined.

“We’re seeing some short covering along with long liquidation, which means that money is moving out of the market,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York, said. “Investors are moving to the sidelines, which is an appropriate response given the volatility.”

The U.S. benchmark oil contract advanced 16 percent in the report week to $45.41 a barrel on the New York Mercantile Exchange. WTI started the seven-day period at $39.31 before the largest three-day rally in 25 years sent futures up 27 percent to $49.20. The contract lost 70 cents to $45.35 a barrel at 3:19 p.m. London time on Monday.

On Sept. 1, oil tumbled by $3.79 a barrel after a report showed manufacturing in China had slowed. Investors redeemed a record 13.8 million shares from the U.S. Oil Fund, the most since the exchange-traded product started trading in 2006. That forced the fund’s managers to liquidate the bullish oil contracts that back its shares.

Crude has declined 51 percent in the past year as rising output from the U.S. and the Organization of Petroleum Exporting Countries outpaced demand growth. Prices will remain at $40 to $60 a barrel into 2016, said Ian Taylor, chief executive officer of Vitol Group BV, the world’s largest independent oil trader.

Other Markets

In other markets, net-long positions on Brent crude were little changed at 140,660 contracts, according to ICE Futures Europe data. Net bullish bets on Nymex gasoline slid 18 percent to 16,383, CFTC data show. Futures fell 3 percent to $1.3956 a gallon. Net bearish wagers on U.S. ultra low sulfur diesel contracted by 14 percent to 28,822 contracts. Diesel futures advanced 13 percent to $1.5779 a gallon.

U.S. crude output is 6.8 percent higher than a year ago even though oil rigs are down by 58 percent. Production has been resilient despite spending cuts as drillers focus on the most prolific properties.

“The guns are loaded and ready to be fired again,” said Kilduff. “They’re waiting for a signal from OPEC or the rig count, or some kind of clear signal that the oversupply is going to be addressed.”

http://www.bloomberg.com/news/articles

Day one, I start looking for leads of people that Cloud Agency management staff need to be talking. Looking through

there website www.cloudams.com and that of the Companies that Offered the same sort of services, looked at thier features and that we had in common and end cost to user, I found that not only is Cams (Cloud Agency Management Software) Softer on the pocket but also doesnt take weeks to train how to use it

, You know as well as do down time is a waste of time.

there website www.cloudams.com and that of the Companies that Offered the same sort of services, looked at thier features and that we had in common and end cost to user, I found that not only is Cams (Cloud Agency Management Software) Softer on the pocket but also doesnt take weeks to train how to use it

, You know as well as do down time is a waste of time.

Rejection and Of Asking the gate for help

Well as to my little adventure down the road as a contact point between Cams and the Agencies from different states, I started to ask myself certain questions,Example.. How do I get the attention of the smaller agencies, When I used to sell Insurance back in my day computers had just came into limelight of how they could connect dailers and fill in orders, etc , most things came back down to old pen and order card, the thought of "paperless Office" wasnt around, ( working from a tablet at a home office: Dream of the Future Tech), we used to drive to the agency and just do walk in and talk to the owner, now-a-days just pick up the phone, ask google and then dail the number and before long I was on 50 calls , stoppd and looked at the number of actuall desicion makers I had to spoke to, stopped and thought about my approach , and soon after doing 5 more calls I had reached what I had set out to do for the day . however the one task i let my self slip on was the pre close Questions...,

So I send my email to couple of people I spoke to with the link to the live demonsration only to find out the people that I invited only half came, the demostraion had some postive results but I was hoping for better,

I came to relize that instead of sayng to the gate keeper and rather asking for thier help got me the desired response, lets see what next week challenges are.

ABOUT US

Cloud Agency Management Software was created to fill a gap between expensive web-enabled CRM and on-site agency management systems. A generic web-based system that usually does not fit the model of an insurance agencies can be very expensive to customize. Very few "out of the box" solutions like Cloud Agency Management Software contain such scalability and flexibility to adapt

CLOUD AGENCY MANAGEMENT SOFTWARE DEMONSTRATION

While other agency management systems provide basic process solutions, Cloud Agency Management Software continues to raise the bar of insurance agency software system innovations. Effectively managing your business is the first step to growing your business. With Cloud Agency Management Software you have all the tools you need to stay organized, paperless, and in tune with your business. Best of all, it is simple and elegant and so easy to use. Nurturing your business is the key to growing to the next level and beyond. Invaluable knowledge at your fingertip will help improve your business, increase your referrals, and grow your business. Discuss how Cloud Agency Management Software can help simplify your business.

855-595-CLOUD / 855-595-2568

855-777-CLOUD / 855-777-2568

713-936-2970 / Stuart

281-746-3032 / James

info@cloudams.com

James@cloudams.com (skype - cloud james)

Stuart@cloudams.com (skype - cloud stuart)